With my trading bot project in NodeJS I want to prove one thing:

One can profit even in bearish markets

Stop Loss Trading explained

What most people involved in trading, be it crypto or stock trading, don’t know: You can even in bear markets improve your position.

If you know, or are quite certain, your asset will one day have a high price you would want to have as much of that asset as you can, right?

Here’s the basic logic:

Does the price drop? Sell after you’re about 5-10% in the red. In worst case you made 5% minus. In best case the price of the asset drops further, which means you can buy in again with the money you still have.

Let me illustrate this.

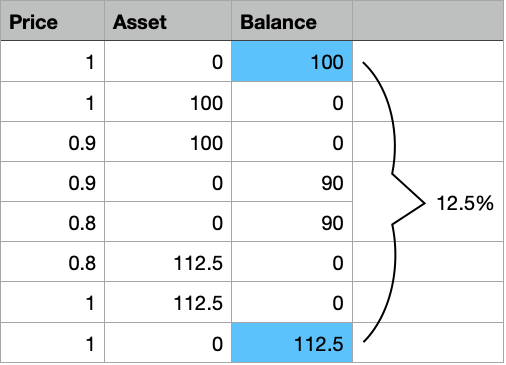

Your asset is at 1 ($/€) and you have 100 ($/€).

You buy the asset, you now have 100 of it, but 0 ($/€) balance.

Price drops to 90 cents. Now you sell, you make a loss, you only receive 90 ($/€) back.

If the price drops furtherto 80 cents, it makes a lot of sense to rebuy in. At 80 cents with 90 ($/€) you now get 112.5 assets.

If the price goes up to 1 ($/€) where you initially bought, you made 12.5% profit!

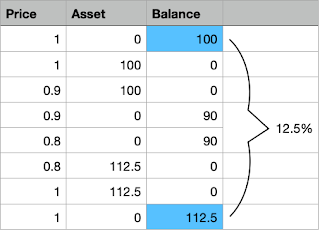

Even if the price only goes back to 90 cents you’ll still make a small profit.

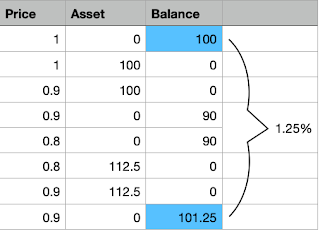

And even if the price drops 50% from 1 ($/€) to 50 cents. It still would pay off to sell now, wait for a further drop.

If you can buy in again at 40 cents, and the asset will only rise to 60% thereafter, you minimised a potential (had you not sold/rebought) 40% loss to only 25% loss.

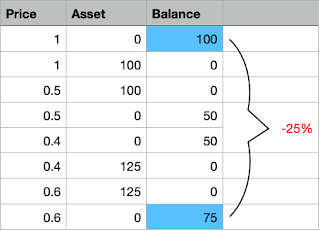

Does the asset go up to 1$ however again, then you made AT YOUR initial price already 25% profit! As a matter of fact, would you not sell at 50 cents and just wait for a 25% profit, the asset would need to go to 1.25 ($/€). At that level IF you had sold at 50 cents and rebought at 40 cents, you’d have a whopping 50% profit already!